24+ pay calculator kentucky

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Overtime must be paid at 1 ½ times the hourly rate for hours worked over 40 in a week.

Kentucky Paycheck Calculator Smartasset

This income tax calculator can help estimate your.

. Web Kentucky Paycheck Calculator. Web How do I use the Kentucky paycheck calculator. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Web The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023. Web Kentucky Paycheck Calculator Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income. Web Benefit Calculation - Kentucky Public Pensions Authority Benefit Calculation The three systems administered by KPPA are qualified defined benefit plans. Web Kentucky Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and.

Figure out your filing status work out your adjusted. Well do the math for youall you. Your average tax rate.

Web Use our free Kentucky paycheck calculator to determine your net pay or take-home pay by inputting your period or annual income along with the pertinent. This free easy to use payroll calculator will calculate your take home pay. Web The process is simple.

The tool provides information for individuals and households with one or two working adults and. A defined benefit plan pays benefits based on a formula. Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Web Kentucky Income Tax Calculator 2022-2023 Learn More On TurboTaxs Website If you make 70000 a year living in Kentucky you will be taxed 11493. Just enter the wages tax. Web Free Paycheck Calculator.

All you have to do is enter each employees wage and W-4 information and our calculator will process their gross pay deductions and net. Simply follow the pre-filled calculator for Kentucky and identify your withholdings allowances and filing status. Web How to calculate annual income.

Formula Final Compensation Benefit Factor Years of Service Annual Benefit. Web Living Wage Calculation for Kentucky. Supports hourly salary income and.

The Kentucky minimum wage is 725 per hour. Web Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. The assumption is the sole provider is working full-time 2080 hours per year.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kentucky.

Take Home Pay Calculator Apk For Android Download

2326 Waterdell Rd Owingsville Ky 40360 29 Photos Mls 20111744 Movoto

2920 L Esprit Pkwy La Grange Ky 40031 Mls 1544718 Redfin

Kentucky Paycheck Calculator Tax Year 2023

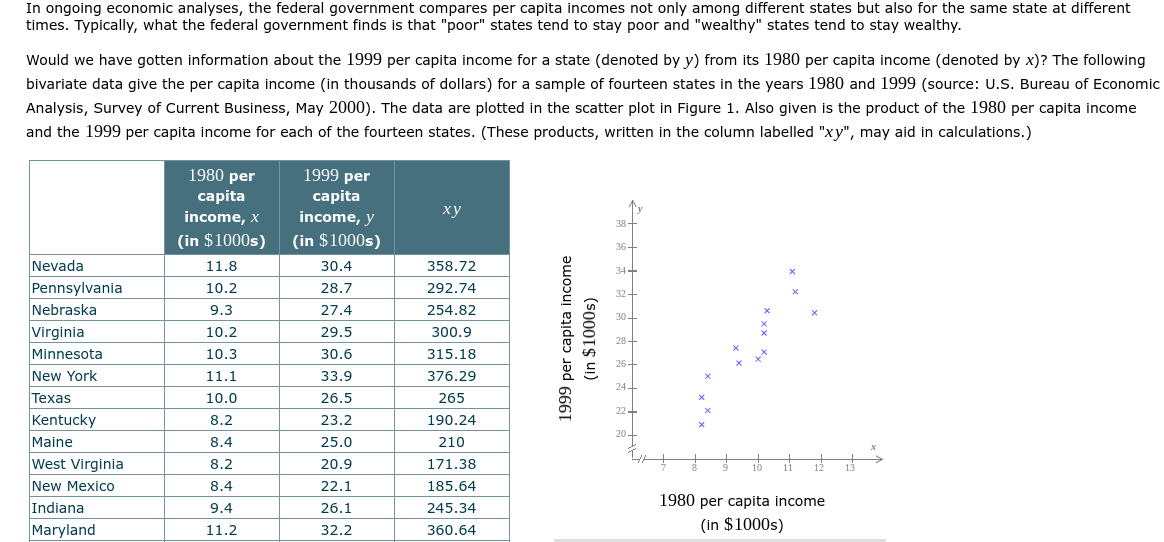

Solved In Ongoing Economic Analyses The Federal Government Chegg Com

Hideaway Apartments 3640 Bold Bidder Drive Lexington Ky Rentcafe

24 Must Read Marketing Books Written By Women

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

Cyperus Graceful Grasses King Tut Buy Papyrus Egyptian Annuals Online

Kentucky Income Tax Calculator Smartasset

Breakbulk Europe 2017 Event Guide By Breakbulk Events Media Issuu

Kentucky Wage Calculator Minimum Wage Org

Kentucky Salary Paycheck Calculator Gusto

Hillview Terrace Apartments 105 Hillview Terrace Greensburg Ky Rentcafe

Kentucky Income Tax Calculator Smartasset

1952 Ky Route 172 Staffordsville Ky 41256 Mls 118262

Paycheck Calculator Kentucky Ky 2023 Hourly Salary